fsa health care plan

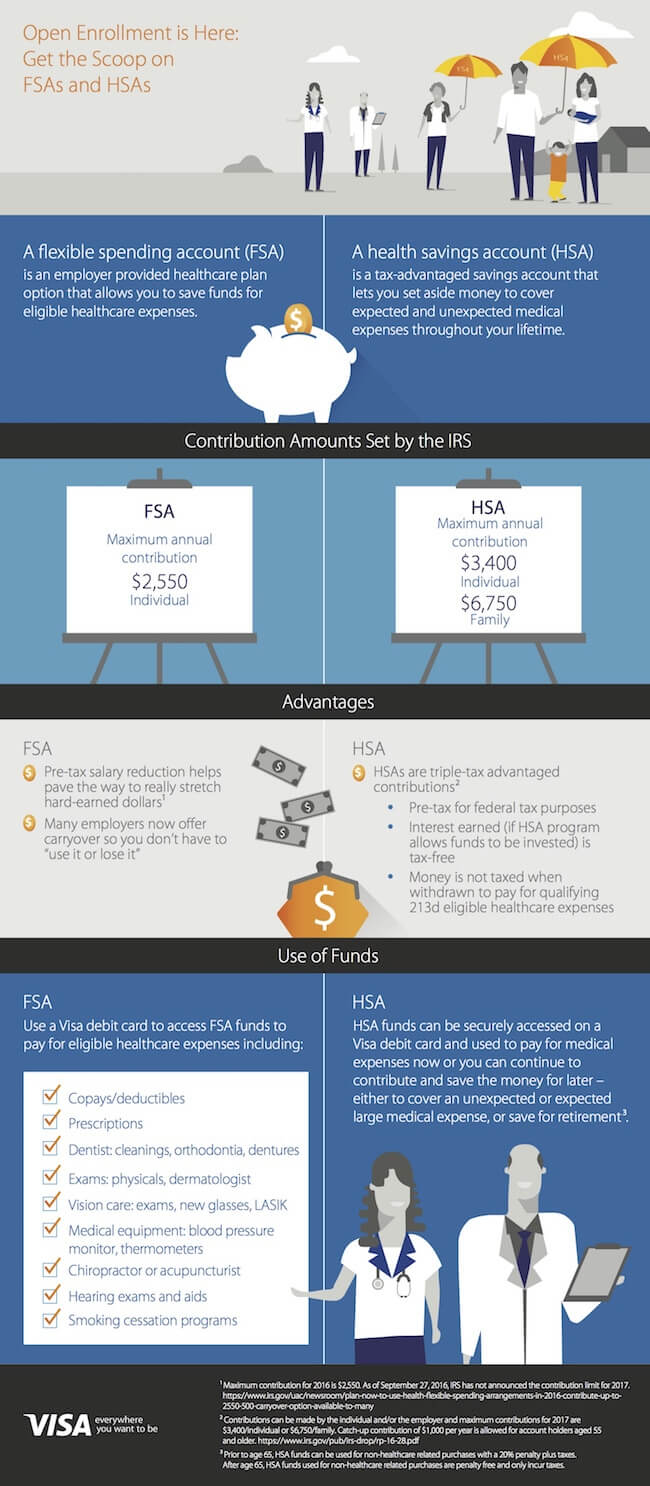

A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses. In the 1970s health reimbursement accounts HRAs were created to help offset rising health care costs.

Flexible Spending Accounts And Your Tax Return Tax Guide 1040 Com File Your Taxes Online

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

. The Healthcare FSA doesnt need to be paired with a specific health insurance plan either. These accounts use pre-tax money from your paycheck that you can use to pay for medical. Paralegal III Supporting the US Attorneys Office Health Care Government Fraud Unit FSA - Newark NJ.

Cafeteria Plan Admin Fsa Health 80 E Passaic Ave Nutley NJ 07110 973 661-2424 Website. Other key things to know about FSAs are. Dependent Care FSA Used to pay for child.

Get directions reviews and information for Cafeteria Plan Admin Fsa Health in Nutley NJ. A Healthcare Flexible Spending Account FSA is a personal expense account that works with an employers health plan allowing employees to set aside a portion of their salary pre-tax to pay. Easiest way to pay for everyday out-of-pocket eligible health care expenses with tax-free money.

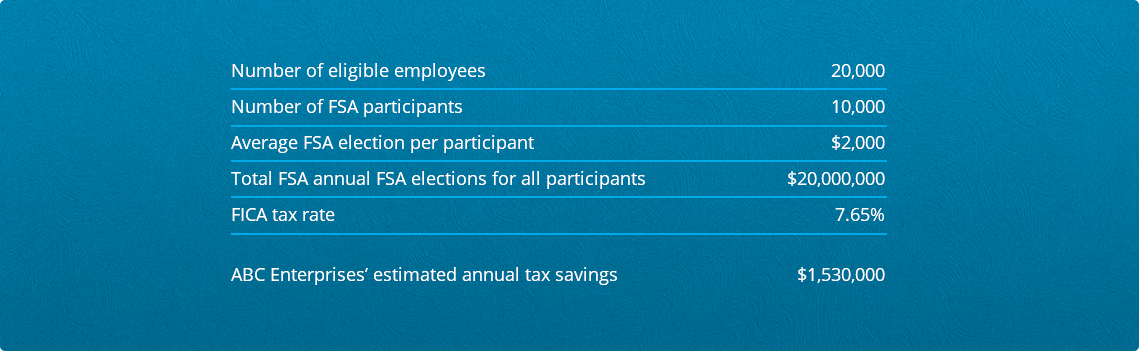

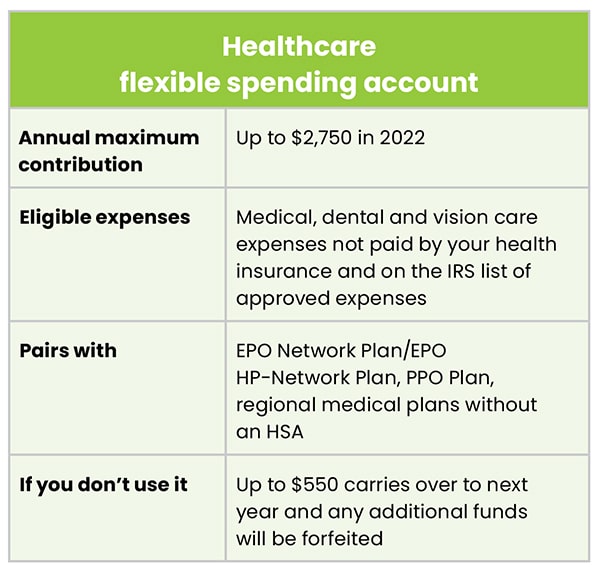

Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the. The 2750 contribution limit applies on an employee-by-employee basis. Your employer provides and.

Your total annual Health Care FSA contribution amount is available immediately at the start of. Flexible Spending Account FSA You can use your Horizon MyWay Flexible Spending Account FSA to pay for a wide variety of health dental and vision care products and services for you. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

QualCare is a full service certified Workers Compensation Managed Care Organization providing healthcare solutions to carriers self-insureds public entities and third party administrators. It helps you save on everyday items like contact lenses sunscreen and bandages. Or those high dollar expenses like surgery orthodontia and hearing.

This means youll save an amount equal to the taxes you would. Be a part of the nationwide law enforcement initiative that removes the tools of. A Flexible Spending Account FSA has benefits you want to pay attention to.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses that are not covered by your health care plan or elsewhere. Healthcare and Dependent Care FSA. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

The Flexible Spending Account FSA is a much sought-after benefit in 2021 as people return to doctors and hospitals for treatment they delayed receiving in 2020 because of. You have options with a health care FSA. You have the flexibility to choose the best insurance plan for your family.

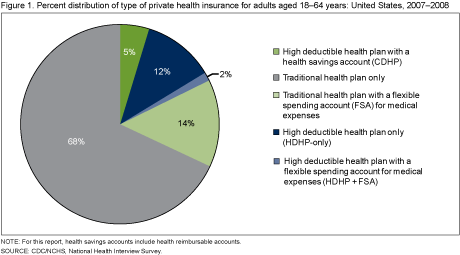

Flexible spending accounts FSAs for medical expenses part of a. Healthcare FSA Used to pay for out -of-pocket medical dental and vision expenses not paid by insurance. You dont pay taxes on this money.

Please refer to your plan documents including specific information on your Health Care FSA or contact your employer for more information on whats covered and not covered by your plan. You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals spouse.

Hsa Health Savings Account Qualified Medical Expenses Qme

Benefits A Z Reimbursement Plans Financial Benefit Services Employee Benefit Solutions

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Products Data Briefs Number 28 February 2010

Request Our Guide To Understanding Your Insurance Co Insurance Life And Health Insurance Health Information Management

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Flexible Spending Account Fsa Cigna

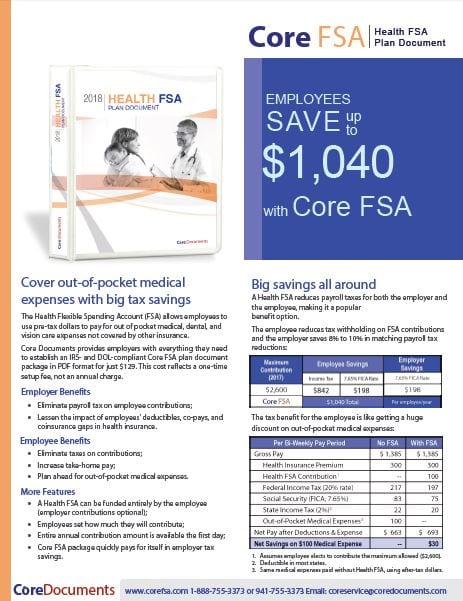

Core Cafeteria Health Fsa Plan Document Brochure Core Documents

Health Care Fsa Contribution Limits Change For 2022

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Page 11 2022 Active Open Enrollment

Hsa Vs Fsa What S The Difference All About Vision

Understanding Your Healthcare Benefits Fsas And Hsas The Soccer Mom Blog

Fsa Vs Hsa Vs Hra Which One Is Better Odyssey Advisors Inc

Section 125 Flexible Spending Accounts Tucker Administrators

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Hsa And Fsa University Of Colorado